The Weekly Times: Incitec defends import policies

Fertiliser giant Incitec Pivot has been forced to defend its continued sourcing of phosphate rock from a disputed North African territory.

Published 31 December 2008

The Weekly Times, December 26 2007.

By ROSLYN LANIGAN

Chairman John Watson told shareholders at its annual general meeting last week the company was not in breach of international law by importing from Western Sahara.

A small group of protestors gathered outside the meeting to urge Incitec Pivot to halt trading with Morocco, which controls Western Sahara.

Inside, shareholders heard that despite another tough year for agricultural Australia, Incitec Pivot's earnings jumped 148 per cent in the year to September 30. Shares in the company have tripled in a year and traded at more than $110 on Friday.

But activists have slammed Incitec Pivot, saying it breaches international law by importing from Western Sahara. Australia Western Sahara Association Victorian secretary Cate Lewis said Morocco was selling the phosphate illegally.

Western Sahara has been fighting for the right to self determination, backed by the United Nations, since Spanish colonisers pulled out in 1976. Ms Lewis said Australian fertiliser companies could make a “big difference” by shunning imports of Western Saharan phosphate.

"If Incitec Pivot joined with the other Australian importers (Wesfarmers CSBP and Impact) and the two New Zealand importers, that group would be the biggest importer of this phosphate in the world,'' she said.

"Phosphate exports are half of the Moroccan economy.'' Ms Lewis said the UN had condemned Morocco for selling resources from the territory and the Federal Government had urged companies to seek legal advice before importing material from Western Sahara.

But Mr Watson said Incitec Pivot fulfilled all international law obligations.

"We look to the UN and the Australian Government to guide us on these matters,'' he said.

He said there would be "significant consequences" for Australian farmers if fertiliser companies halted trade with Morocco.

"Without rock from Western Sahara, it is unlikely that Australian manufacturers could produce the one million tonnes of single superphosphate farmers require each year,'' he said.

Incitec Pivot chief executive Julian Segal said fertiliser prices would remain high next year due to strong demand and a tight international market.

"I can't see in the short and medium term any change in this demand and, on the supply side, there isn't a huge pipeline of new projects coming up,'' Mr Segal said.

"You are not going to see the price of fertiliser going back to what it was a few years ago. I think this is a new sustainable level of prices.''

News

New report: Western Sahara phosphate trade halved

The export of phosphate rock from occupied Western Sahara has never been lower than in 2019. This is revealed in the new WSRW report P for Plunder, published today.

24 February 2020

WSRW to Incitec Pivot - 03.12.2019

03 December 2019

New report on Western Sahara phosphate industry out now

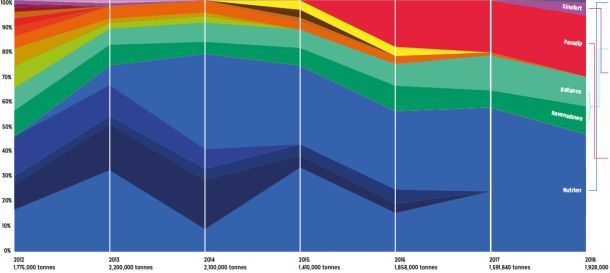

Morocco shipped 1.93 million tonnes of phosphate out of occupied Western Sahara in 2018, worth an estimated $164 million, new report shows. Here is all you need to know about the volume, values, vessels and clients.

08 April 2019

New report on contentious Western Sahara phosphate trade

Morocco shipped over 1.5 million tonnes of phosphate out of occupied Western Sahara in 2017, to the tune of over $142 million. But the number of international importers of the contentious conflict mineral is waning, WSRW's annual report shows.

25 April 2018